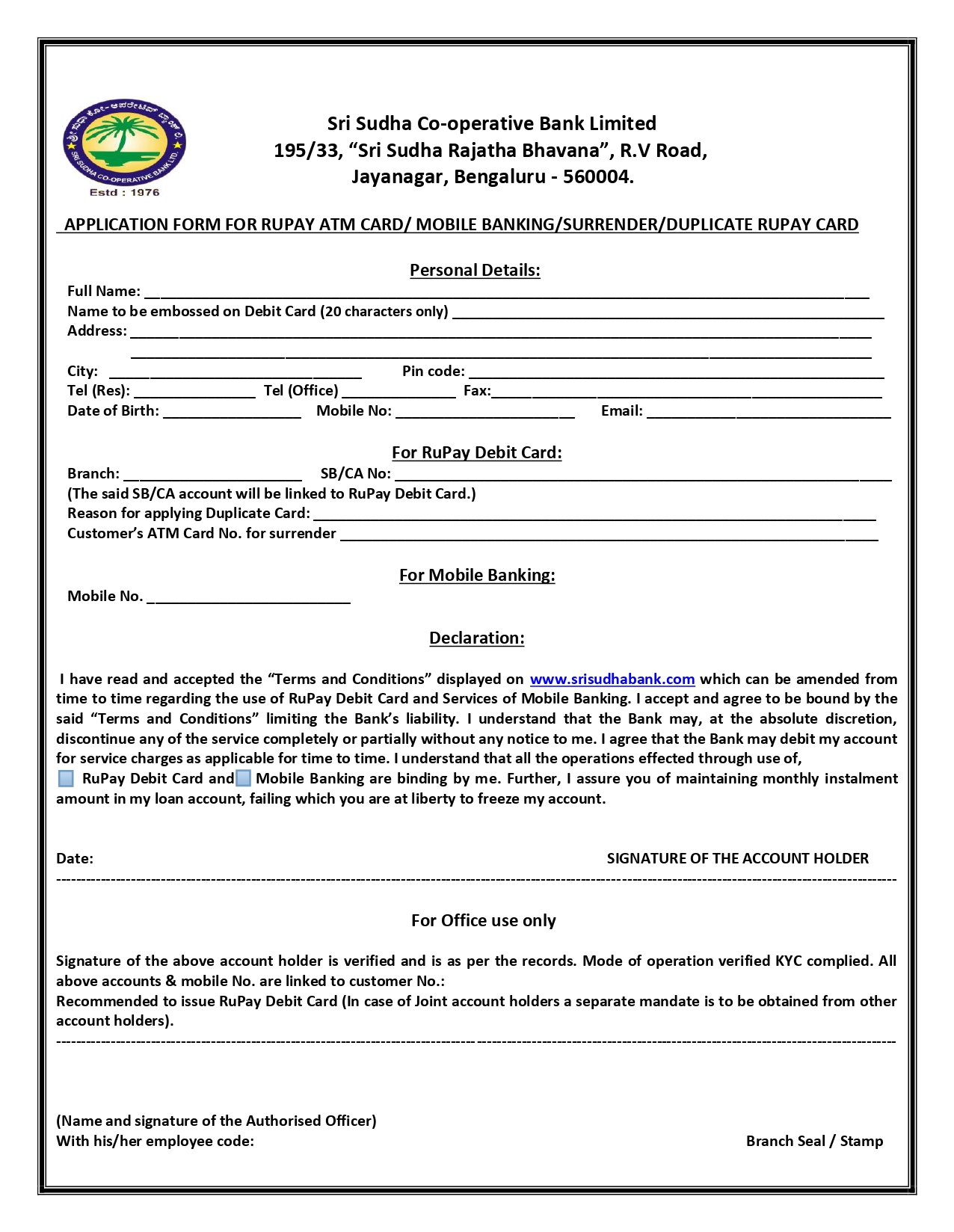

Download ATM Card/Mobile Banking Application Form

Download PDF

The Terms and Conditions under which The RuPay Debit Card has been issued are mentioned below:

A) Terms used here:

- Bank means The Sri Sudha Co-Op. Bank Ltd.,

- Card Means RuPay Debit Card Issued to customer.

- Cardholder means customer who has been issued RuPay Debit Card.

B) The Card:

- The Card is the property of the Bank and shall be returned unconditionally and immediately to the Bank upon request by the Bank.

- The Bank reserves the right to cancel the card and stop its operations unilaterally without assigning any reason.

- The Card is non-transferable.

C) The Pin:

The Card Holder is initially allotted a computer generated 4-digit PIN which will be in a secured and sealed PIN mailer. The Card Holder is advised in his own interest to change this PIN to any other 4-digit number of his/her choice. For this purpose, he may use the PIN change option available at Any-ATM. While selecting a PIN, the cardholder is advised to avoid a PIN which can be easily associated with him/her (e.g. Telephone number, DOB etc.) Besides, the selected PIN value should not of compromise of

- Any sequence from the associated account number.

- String of the same number.

- Historically significant dates.

Please remember that an un-authorized person can access the ATM services on cardholder's account if he gains the card and PIN. The card, therefore, should remain in Card Holder's possession and should not be handed over to anyone else. The Card is issued on the condition that the Bank bears no liability for the un-authorized use of the Card. This responsibility is fully that of the Card Holder. Further the bank will not be responsible for any loss either direct or indirect on account of ATM failure/ mal-functioning.

D) Loss of Card:

- The Card Holder should immediately notify the Branch from where he/she has obtained the card, if the card is lost/stolen. The Cardholder should change the PIN immediately if it is accidentally divulged.

- Any financial loss arising out of unauthorised use of Card till such time the Bank record the notice of loss of Card will be to the Card holder's account.

- Fresh card will be issued in replacement of lost / damaged card at charge of Rs. 100/-

E) Debit to Customer’s Account:

- The bank has the express authority to debit the designated account of the cardholder for all withdrawals / transfers effected using the Card as evidenced by Bank's records, which will be conclusive and binding on the Card Holder.

- The Card Holder expressly authorises the Bank to debit the designated account with service charges from time to time.

F) Transactions:

The transaction record generated by the ATM will be conclusive and binding unless found to be otherwise on verification and corrected by the bank. The verified and corrected amount will be binding on the Card Holder's Deposits (cash and /or cheques etc.) and will be verified by two officials of the Bank and their account will be deemed to be correct.

G) Closing of Accounts:

The Card Holder wishing to close the designated account or surrender the ATM facility will give the Bank 10 working days’ notice in writing and surrender the Card along with the notice.

H) Validity of Card:

As per mentioned on the card.

J) ATM Services: RuPay Debit Card:

- Cash Withdrawals: Cardholders may withdraw minimum of Rs. 100/- and maximum of Rs. 20000/- per day, subject to the daily limit fixed by the bank from time to time.

- Balance Enquiry: Cardholder can see the balance in his account linked to RuPay Debit Card on the screen as well as obtained during the day mode.

- Statement of Account: A statement containing the last five transactions in the account can be obtained during the day mode.

- Change of PIN: Customers can change their PIN at any Networked ATM.

Before you begin using your card.

- Sign on the signature panel at the back of the card as soon as you receive it.

- Use your new card immediately at any ATM in the NFS network to change the system generated PIN to a new 4-digit number of your choice.

- Memorize your PIN and destroy the PIN mailer.

- Never write down your PIN on your card. Remember the PIN instead of writing it down.

Do's:

- Keep your PIN secret.

- Change your PIN regularly. Preferably, change it every quarter.

- In case of loss or theft of your card, call our Customer care No. on 9513372372 or 9513973973 between 9.00 am to 9.00 p.m. or visit any nearest branch immediately and request for the blocking of the card.

- Keep your card away from sunlight, T.V. and magnetic products.

- If you have two cards, take care that the magnetic stripes of the two cards do not rub against each other.

- Any Fraudulent transaction may immediately be reported to bank.

Dont's:

- Do not give your card to anyone and do not share your PIN with anybody (including your family members, friends, your banker, or anybody else)

- Never leave your card unattended. Keep your card in a place where you will immediately trace in case of missing.

- Avoid taking any help from anybody under any circumstances at an ATM.

- Never let anyone see your ATM Pin. The safest measure is to ensure that you are alone in the ATM while your conducting your transactions.

- Always Dip your EMV chip card to enjoy enhanced security for your transactions.

- Do not swipe your EMV chip card at chip enabled terminals to ensure better security.

- Do not bend the card or scratch the magnetic stripe behind the card.

- Remember that the Sri Sudha Cooperative Bank Ltd., will never ask financial/personal/debit card related information via email. Thus, please do not respond to emails seeking such information. They may be fraudulent.